Fascination About Pvm Accounting

Fascination About Pvm Accounting

Blog Article

Excitement About Pvm Accounting

Table of ContentsPvm Accounting Fundamentals ExplainedThe 6-Minute Rule for Pvm AccountingPvm Accounting Fundamentals ExplainedThe Pvm Accounting StatementsSome Known Incorrect Statements About Pvm Accounting Pvm Accounting Things To Know Before You Buy

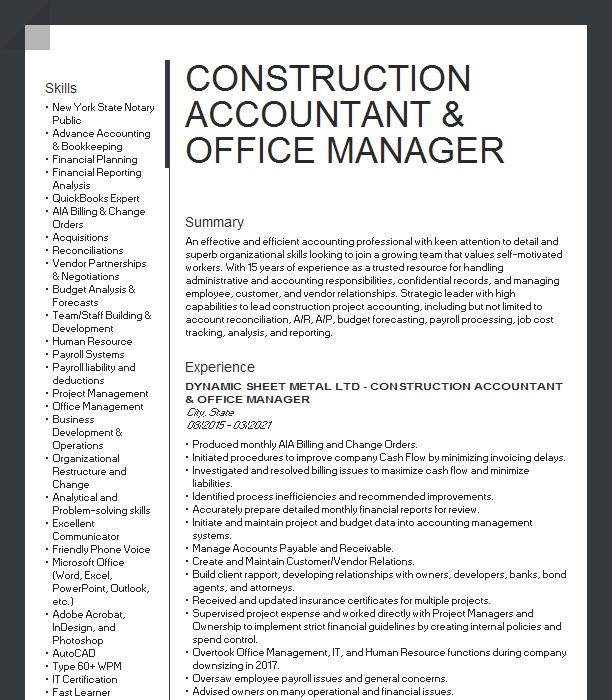

Look after and manage the production and approval of all project-related payments to consumers to foster excellent communication and prevent problems. construction accounting. Make sure that appropriate records and documents are sent to and are updated with the internal revenue service. Ensure that the accountancy procedure conforms with the legislation. Apply called for construction bookkeeping criteria and treatments to the recording and reporting of building task.Communicate with various funding agencies (i.e. Title Firm, Escrow Company) concerning the pay application process and requirements needed for settlement. Aid with implementing and maintaining inner economic controls and procedures.

The above statements are intended to describe the basic nature and level of job being executed by individuals assigned to this category. They are not to be taken as an extensive listing of obligations, tasks, and skills called for. Employees might be needed to carry out tasks outside of their normal responsibilities every now and then, as needed.

The Single Strategy To Use For Pvm Accounting

You will certainly help sustain the Accel team to ensure shipment of successful on time, on budget plan, projects. Accel is looking for a Construction Accountant for the Chicago Workplace. The Building Accounting professional carries out a range of bookkeeping, insurance policy compliance, and task administration. Functions both separately and within details departments to preserve economic documents and make sure that all documents are maintained current.

Principal obligations consist of, but are not limited to, taking care of all accounting functions of the company in a timely and exact fashion and supplying records and schedules to the business's certified public accountant Firm in the preparation of all monetary declarations. Ensures that all bookkeeping treatments and features are taken care of properly. In charge of all financial documents, payroll, banking and daily operation of the accountancy function.

Functions with Job Managers to prepare and upload all regular monthly billings. Creates regular monthly Job Price to Date reports and working with PMs to reconcile with Task Supervisors' spending plans for each task.

Some Known Factual Statements About Pvm Accounting

Proficiency in Sage 300 Building And Construction and Property (previously Sage Timberline Office) and Procore building monitoring software application an and also. https://fliusp-dyneord-typeiasts.yolasite.com. Should additionally be efficient in other computer system software systems for the preparation of records, spreadsheets and other bookkeeping evaluation that might be required by administration. financial reports. Need to have strong organizational abilities and capacity to prioritize

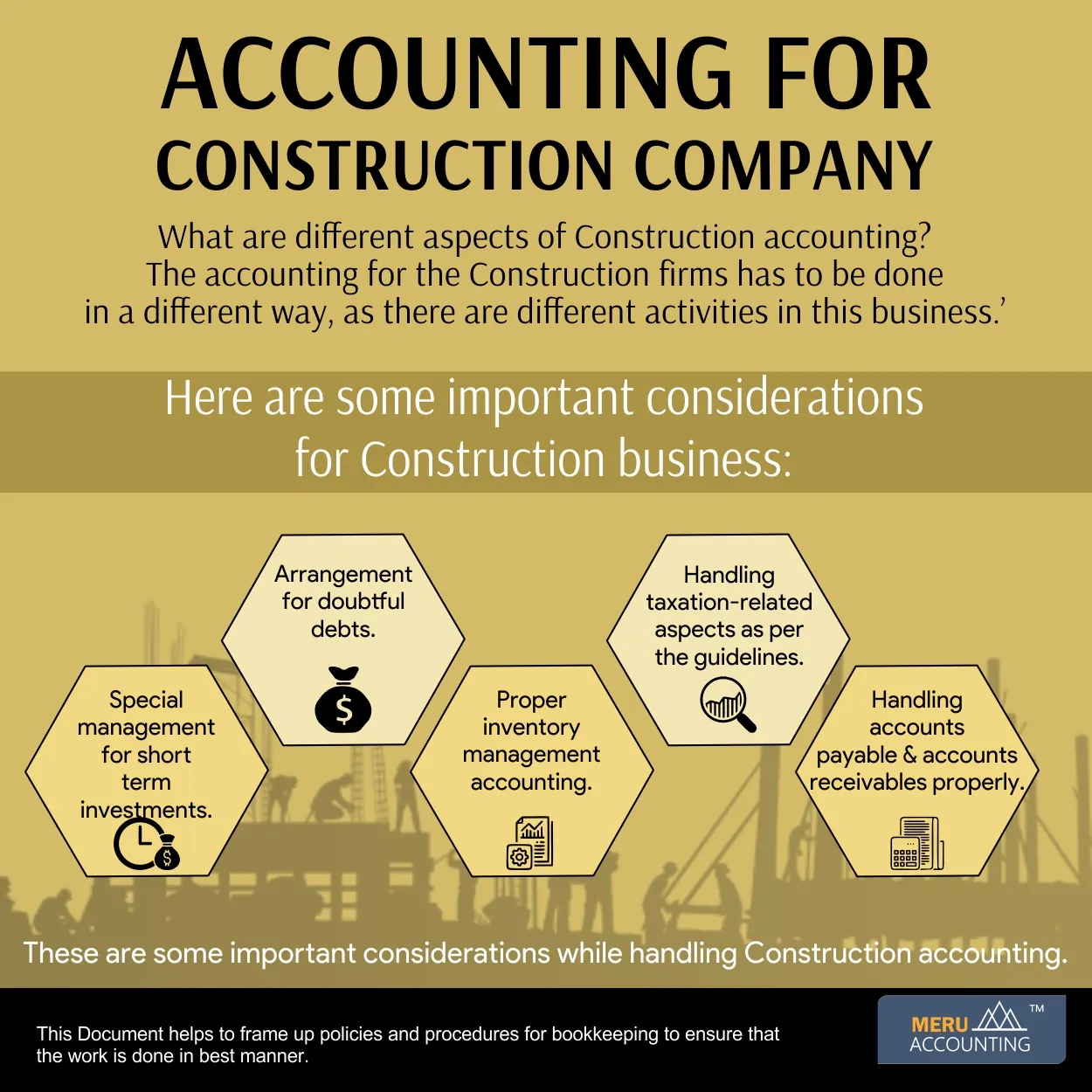

They are the monetary custodians that ensure that building tasks continue to be on budget plan, abide by tax obligation guidelines, and preserve monetary openness. Building and construction accountants are not just number crunchers; they are tactical companions in the building procedure. Their main duty is to handle the economic aspects of building jobs, making certain that resources are alloted efficiently and financial dangers are reduced.

What Does Pvm Accounting Do?

By keeping a limited grip on task funds, accounting professionals help protect against overspending and monetary setbacks. Budgeting is a keystone of successful construction tasks, and building accounting professionals are critical in this respect.

Construction accountants are skilled in these laws and make certain that the job abides with all tax demands. To stand out in the role of a building accounting professional, individuals need a solid academic foundation in bookkeeping and finance.

Furthermore, qualifications such as Qualified Public Accountant (CERTIFIED PUBLIC ACCOUNTANT) or Qualified Building And Construction Sector Financial Expert (CCIFP) are highly concerned in the market. Working as an accountant in the construction industry comes with an unique set of challenges. Building projects frequently include tight due dates, changing policies, and unexpected expenses. Accountants must adjust rapidly to these challenges to keep the project's economic health undamaged.

The Best Guide To Pvm Accounting

Specialist certifications like certified public accountant or CCIFP are additionally very advised to show experience in construction audit. Ans: Building and construction accountants create and monitor spending plans, recognizing cost-saving chances and guaranteeing that the task stays within spending plan. They also track expenditures and forecast economic demands to stop overspending. Ans: Yes, construction accountants take care of tax compliance for building and construction jobs.

Intro to Construction Audit By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Construction firms have to make challenging selections amongst numerous economic alternatives, like bidding process on one task over one more, picking financing for products or tools, or setting a task's revenue margin. Construction is an infamously volatile industry with a high failing price, slow-moving time to payment, and irregular money circulation.

Common manufacturerConstruction business Process-based. Manufacturing involves repeated procedures with easily recognizable expenses. Project-based. Manufacturing my explanation needs different processes, materials, and tools with varying expenses. Repaired area. Manufacturing or manufacturing occurs in a solitary (or a number of) regulated locations. Decentralized. Each project happens in a new area with varying website problems and unique difficulties.

The smart Trick of Pvm Accounting That Nobody is Talking About

Resilient partnerships with suppliers reduce negotiations and improve efficiency. Inconsistent. Regular use different specialty service providers and distributors influences performance and capital. No retainage. Repayment gets here completely or with normal payments for the full agreement amount. Retainage. Some section of settlement might be held back up until project completion even when the specialist's work is completed.

While typical producers have the benefit of controlled atmospheres and maximized production procedures, construction firms must continuously adjust to each new job. Also somewhat repeatable jobs require adjustments due to website conditions and other variables.

Report this page